The last auction of this kind...

Insights

The fourth capacity market auction was held on the 6th of December 2019. Although there were some long-awaited new projects, the Santa Claus gift (which the capacity market support could be) was offered primarily to the existing coal-fired units, which in most cases decided to modernize. They were allowed to participate in the auction for the last time, as the European Union regulations will not allow such participation from next year.

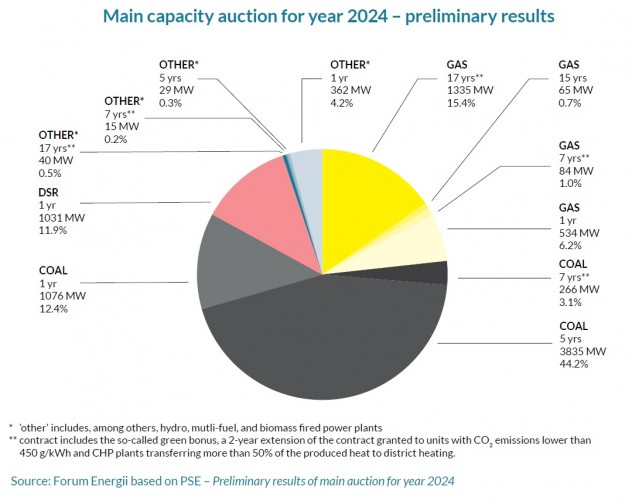

The preliminary results of the fourth auction provided by Polskie Sieci Elektroenergetyczne (PSE) show that capacity agreements were concluded for 8671.154 MW at PLN 259.87 per kW/year (more than EUR 60). After taking into account the agreements longer than one year from the previous auctions, a total of 22.1 GW was contracted for 2024. The final results will be published by the President of the Energy Regulatory Office within 21 days after the auction.

- The auction resulted in launching the long-awaited new projects. But only three. PGE was awarded a capacity contract (1335 MW) for two CCGT units in Dolna Odra (north-west of Poland). The agreement for this long-planned investment will be in force for 17 years (including the so-called green bonus 1), i.e. until the end of 2040. Another two new investments are the Synthos Dwory gas unit (15-year contract for 65 MW) and a small unit ZE PAK (17-year contract for 40 MW).

- It is worth recalling that 75 new generation units with a total capacity of over 10.5 GW, were reported in the general certification and could potentially participate in the fourth auction. Of these, more than 4 GW in gas-fired power plants. However, so far neither the Energa unit in Grudziądz nor the second of PGE's planned gas investments - the one in Rybnik - has appeared. Therefore, gas units need either an even higher price or the projects are not yet advanced enough to be ready to provide capacity in five years' time.

- In contrast to the second and third auctions, the fourth auction was dominated by 5- and 7-year contracts which could be offered to modernized units. This is as much as half of the contracted capacity, including the units of the Bełchatów power plant. This will allow them to receive payments in the years 2024-2028, i.e. for a maximum period of time under the emission limits (550 g CO2/MWh).

- Another record was noted by DSR, which received contracts for more than 1 GW. The share of DSR in the auctions is systematically growing, but this segment is dominated by aggregators, although this year one new player appeared - PGE. However, despite high expectations - as much as 5.6 GW in the general certification - not a single storage was successful in the auction.

- The Polish capacity market is expensive. The price of the fourth auction was set at 259.87 PLN/kW/year and is the highest ever. This is due to the fact that the auction was attended by many price-makers - new or modernised generation units and DSR, that need higher incentives 2.

- The capacity market costs all of us a lot. Already incurred liabilities (auctions for the years 2021-2023) have reached PLN 35 billion. The bill for the fourth auction will amount to PLN 2.3 billion. This will result in the improvement of the financial condition of the generators and the strengthening of their position, but it will be paid for by the energy consumers.

- PGE dominates the capacity market. In the fourth auction, PGE contracted as much as 58% of the available capacity.

This year's auction was the last one, in which existing coal-fired power plants could compete. Most of them conscientiously took advantage of this opportunity by deciding to modernise and winning contracts until 2028. After that date, they will still be able to operate, but they will receive revenues only from the energy market. The fact that modernised, new and DSR units dominated resulted in the price being set at a high level. Such results are also to be expected next year when, due to the limit of 550 g, the existing coal-fired units (the price-takers) will not be able to take part. Until then, however, we are waiting for a discussion on what to do next with the capacity market.

Authors: Aleksandra Gawlikowska-Fyk, Phd Head of Power Project and Rafał Macuk, Analyst in the Forum Energii.

Date of publication: 12 December 2019

- 2-year extension of the contract granted to units with CO2 emission capacity lower than 450 g/kWh and to CHP plants transferring more than 50% of the heat produced to the district heating system.

- The auction parameters for 2024 were as follows: the entry price of a new generation unit to the market was PLN 311/kW, and the maximum price set for a price taker was PLN 183/kW. Regulation of the Minister of Energy of 2 August 2019 on the parameters of the main auctions for 2024 and the parameters of the additional auctions for 2021, Dz.U. 2019, item 1457.